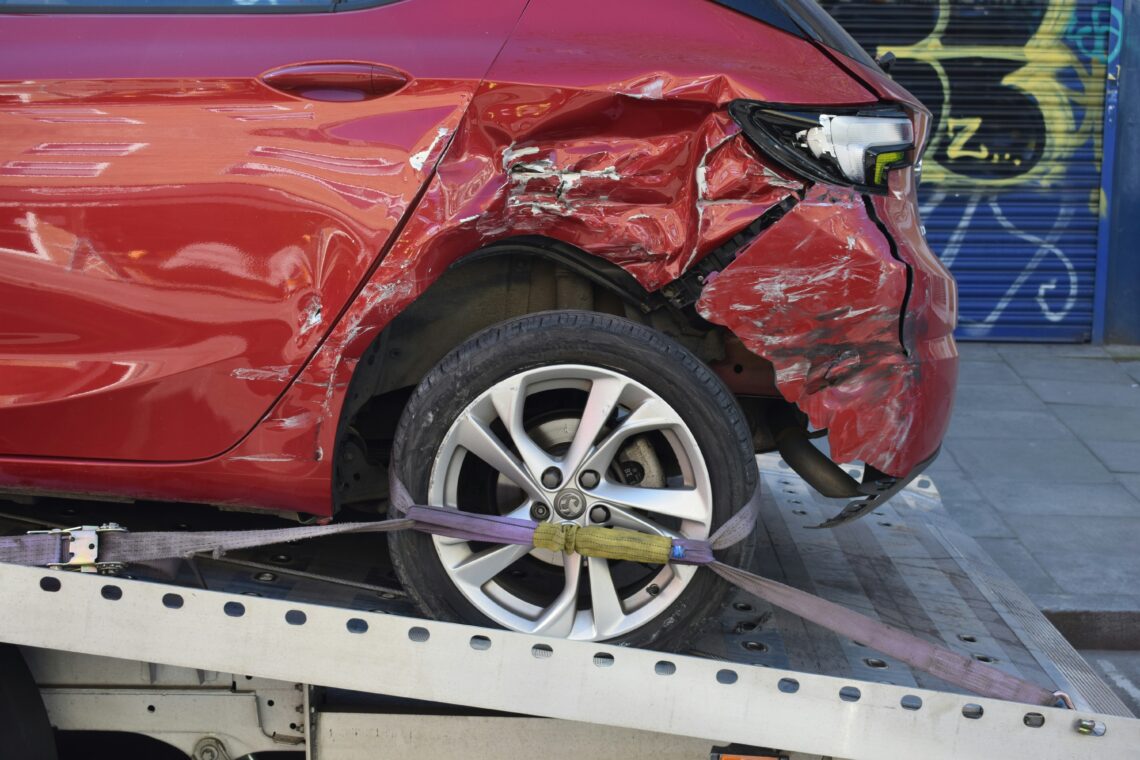

Understanding car accident liability insurance can be confusing. Among the most critical coverages is liability insurance. This guide explains how liability insurance works in Georgia, what it covers, and why it’s fundamental to protecting yourself and others on the road.

At Burrow & Associates, we help clients in Atlanta and across Georgia navigate the complexities of car accident claims, ensuring their rights are protected when they are seeking compensation.

What Is Auto Liability Insurance in Georgia?

Auto liability insurance is a mandatory component of car insurance in Georgia, designed to financially protect you if you are at fault for an accident. It pays for damages and injuries you cause to other people and their property, up to your policy limits.

It does NOT cover: Your own medical bills or damage to your own vehicle if you are at fault. For that, you would need Medical Payments (MedPay) or Personal Injury Protection (PIP – not available in GA), and Collision coverage, respectively.

Georgia’s Minimum Liability Insurance Requirements

Every driver in Georgia is legally required to carry specific minimum liability insurance limits. These are often referred to as “25/50/25”:

- $25,000 for bodily injury or death of one person in an accident.

- $50,000 for total bodily injury or death of all people in a single accident.

- $25,000 for damage to another person’s property in an accident.

While these are the minimums, it’s often advisable to carry higher limits to adequately protect your assets in case of a severe accident, as you can be held personally liable for damages exceeding your coverage. You can find official requirements on the Georgia Office of Insurance and Safety Fire Commissioner’s website.

What Does Liability Insurance Cover?

Liability insurance consists of two main parts, each covering specific types of damages for others:

- Bodily Injury Liability (BI): Covers expenses related to injuries you cause to others.

- Medical bills (ambulance, hospital, doctor visits, therapy)

- Lost wages due to injury

- Pain and suffering

- Legal fees if you are sued

- Funeral expenses

- Property Damage Liability (PD): Covers costs to repair or replace property you damage.

- Damage to other vehicles

- Damage to buildings, fences, mailboxes, or other structures

- Damage to personal property inside another vehicle (e.g., laptop, phone)

- Reporting the Accident: Georgia law requires you to report accidents resulting in injury, death, or property damage exceeding $500 to the police.

- Proving Fault: As Georgia is an “at-fault” state, you must demonstrate the other driver’s negligence.

- Documenting Damages: Collect all medical records, bills, proof of lost wages, and repair estimates for your vehicle.

- Negotiating with Their Insurer: The other driver’s insurance company will assign an adjuster whose goal is to minimize payout. They may dispute fault or the extent of your damages.

- Investigate the accident to establish fault.

- Gather comprehensive evidence of your damages.

- Negotiate aggressively with insurance adjusters.

- File a lawsuit if necessary to secure the compensation you deserve.

Liability Insurance vs. “Full Coverage”

It’s common to hear the term “full coverage,” but this isn’t a specific type of policy. Instead, it’s a general term usually referring to an auto insurance policy that includes more than just the mandatory liability coverage.

| Feature | Liability Insurance | “Full Coverage” (Includes Liability) |

|---|---|---|

| Who it protects | Others (third parties) | Others AND your own vehicle/injuries |

| What it covers | Injuries & property damage you cause to others | Injuries & property damage you cause to others, plus damage to your own car (Collision), non-collision damage to your car (Comprehensive), and often MedPay/UM/UIM |

| Mandatory in GA? | Yes | No (only Liability is required) |

| Covers your car? | No | Yes (via Collision & Comprehensive) |

| Covers your injuries? | No | Yes (via MedPay/PIP, if purchased) |

Filing a Claim Against Another Driver’s Liability Insurance

If another driver caused your accident, their liability insurance is responsible for compensating you. Filing a claim against their policy involves:

Dealing with another party’s insurance can be challenging and frustrating. Having an experienced car accident attorney on your side ensures you meet all legal obligations and that the insurance company treats you fairly.

Contact Burrow & Associates for Liability Insurance Claims in Georgia

Whether you’re facing a claim against your own liability policy or seeking compensation from an at-fault driver’s insurance, the process can be complex. Don’t let insurance companies take advantage of you.

The dedicated car accident attorneys at Burrow & Associates understand Georgia’s liability laws and insurance tactics. We can help you:

If you have questions about liability insurance or need assistance with a car accident claim in Atlanta or across Georgia, contact us today for a free consultation. We’re here to protect your rights and fight for your financial recovery.